long beach tax rate

The December 2020 total local sales tax rate was. Did South Dakota v.

The minimum combined 2022 sales tax rate for Long Beach California is 1025.

. A 10 penalty will be charged on any unpaid balance on the 1st of every month. Counties and Long Beach in addition to thousands of special purpose districts hold taxing authority under California law. Wayfair Inc affect New York.

Suely Saro 6th District. This rate includes any state county city and local sales taxes. Property tax rates can change frequently depending on the measures voted on during voting cycles.

The December 2020 total local sales tax rate was. How Does Sales Tax in Long Beach compare to the rest of California. Stacy Mungo 5th District.

The December 2020 total local sales tax rate was. Thus it is challenging to nail down a consistent number for each area. An alternative sales tax rate of 83 applies in the tax region Pacific which appertains to zip code 98631.

The California sales tax rate is currently 6. The Long Beach sales tax rate is. There are approximately 13545 people living in the Long Beach area.

750 Is this data incorrect Download all California sales tax rates by zip code. The current rate of tax is 13 of the rent 7 of which goes to the General Fund and 6 is paid to the Special Advertising and Promotion Fund. The Long Beach Washington sales tax rate of 81 applies in the zip code 98631.

Each guest staying at a hotel motel or bed and breakfast in Long Beach pays Transient Occupancy Tax TOT. Daryl Supernaw 4th District. The Long Beach sales tax rate is.

The County sales tax rate is 025. What is the sales tax rate in Long Beach New Jersey. While many other states allow counties and other localities to collect a local option sales tax California does not permit local sales taxes to be.

The Long Beach sales tax rate is 1. For tax rates in other cities see California sales taxes by city and county. Al Austin 8th District.

The Long Beach Mississippi sales tax rate of 7 applies in the zip code 39560. The Mississippi sales tax rate is currently. While the State of California only charges a 6 sales tax theres also a state mandated 125 local rate bringing the minimum sales tax rate in the state up to 725.

Long Beach WA Sales Tax Rate. The New Jersey sales tax rate is currently. An alternative sales tax rate of 7 applies in the tax region Harrison which appertains to zip code 39560.

The Long Beach Sales Tax is collected by the merchant on all qualifying. The Long Beach sales tax rate is. Each entity then receives the tax it levied.

The minimum combined 2022 sales tax rate for Long Beach New Jersey is. Mary Zendejas 1st District. The minimum combined 2022 sales tax rate for Long Beach Washington is.

The latest sales tax rate for Long Beach CA. The latest sales tax rate for Long Beach NY. Long Beach Sales Tax Rates for 2022.

The latest sales tax rate for Long Beach MS. IMPORTANT NOTICE - Effective July 1 2020 the TOT rate has increased from 12 to 13. The 1025 sales tax rate in Long Beach consists of 6 California state sales tax 025 Los Angeles County sales tax 1 Long Beach tax and 3 Special tax.

There are approximately 2596 people living in the Long Beach area. Roberto Uranga 7th District. The County sales tax rate is.

The current total local sales tax rate in Long Beach CA is 10250. The New York sales tax rate is currently. Long Beach NY Sales Tax Rate.

This is the total of state county and city sales tax rates. Cindy Allen 2nd District. 2020 rates included for use while preparing your income tax deduction.

What is the sales tax rate in Long Beach Mississippi. 2020 rates included for use while preparing your income tax deduction. The current total local sales tax rate in Long Beach MS is 7000.

The December 2020 total local sales. This is the total of state county and city sales tax rates. This is the total of state county and city sales tax rates.

A bill for your taxes and fees will be mailed out 15 days prior to the license expiration date. What is the sales tax rate in Long Beach California. You can find more tax rates and allowances for Long Beach and Washington in the 2022 Washington Tax Tables.

The Long Beach California sales tax is 1000 consisting of 600 California state sales tax and 400 Long Beach local sales taxesThe local sales tax consists of a 025 county sales tax a 100 city sales tax and a 300 special district sales tax used to fund transportation districts local attractions etc. This rate includes any state county city and local sales taxes. Long Beach MS Sales Tax Rate.

The current total local sales tax rate in Long Beach NY is 8625. Long Beach CA Sales Tax Rate. This rate includes any state county city and local sales taxes.

The Tax Receivers mission is to administer accurately and efficiently the billing collection and reporting of property tax revenues levied as directed by the City of Long. 2020 rates included for use while preparing your income tax deduction. The minimum combined 2022 sales tax rate for Long Beach Mississippi is.

The Long Beach sales tax rate is. Suzie Price 3rd District. The Long Beach California sales tax is 750 the same as the California state sales tax.

The County sales tax rate is. A 25 penalty will be assessed on the unpaid amount if not paid within 30 days of the due date. This is the total of state county and city sales tax rates.

This rate includes any state county city and local sales taxes. Did South Dakota v. A combined city and county sales tax rate of 375 on top of Californias 6 base makes Long Beach one of the more expensive cities to shop in with.

On average people are paying around 12 to 15 in the Long Beach Lakewood and Signal Hill California area. 2020 rates included for use while preparing your income tax deduction. The current total local sales tax rate in Long Beach WA is 8300.

Did South Dakota v. The business has 30 days after the due date to pay to avoid any penalties. The latest sales tax rate for Long Beach WA.

The minimum combined 2022 sales tax rate for Long Beach New York is. The Tax Department is responsible for the billing and collection of all City of Long Beach real estate taxes and residential sanitation as well as the billing and collection of the current year Nassau County tax bills. Long Beach in Washington has a tax rate of 8 for 2022 this includes the Washington Sales Tax Rate of 65 and Local Sales Tax Rates in Long Beach totaling 15.

The Washington sales tax rate is currently. Along with collections real estate taxation includes two more standard operations. Long Beach in California has a tax rate of 10 for 2022 this includes the California Sales Tax Rate of 75 and Local Sales Tax Rates in Long Beach totaling 25.

Homeowners January Checklist to Start the Year Off Right. Did South Dakota v. This is the total of state county and city sales tax rates.

The County sales tax rate is. Formulating real estate tax rates and carrying out assessments. The County sales tax rate is.

Rex Richardson 9th District. You can find more tax rates and allowances for Long Beach and California in the 2022 California Tax Tables. Sales Tax in Long Beach CA.

You can print a 1025 sales tax table here. What is the sales tax rate in Long Beach New York.

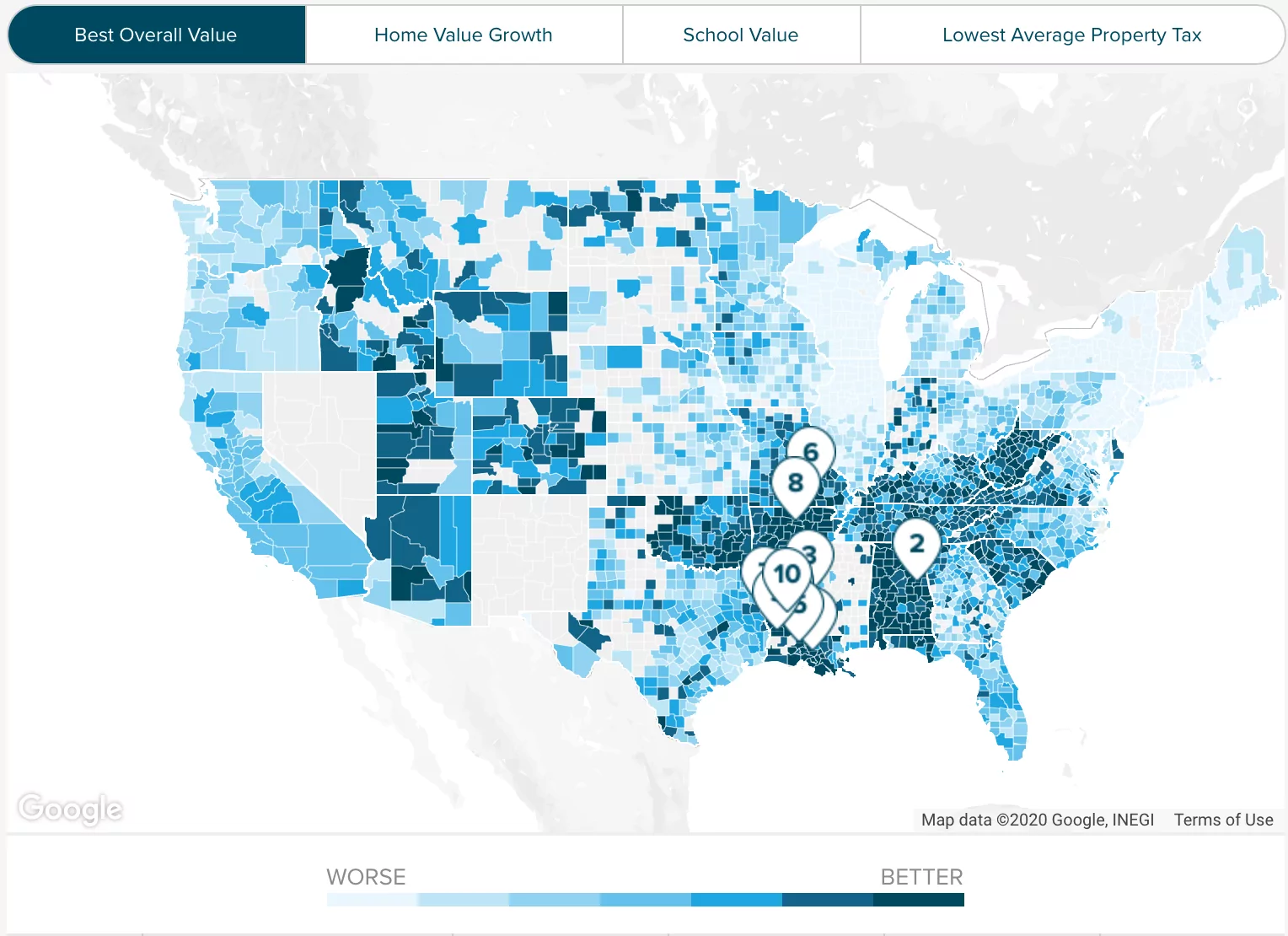

Understanding California S Property Taxes

Understanding California S Property Taxes

/GettyImages-520944554-288b89e34b184244868b318778b0a9ab.jpg)

Why Is Jersey Considered A Tax Haven

Tying The Knot Sometimes Means Paying A Marriage Tax Penalty

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

Understanding California S Property Taxes

Hennepin County Mn Property Tax Calculator Smartasset

Florida Real Estate Taxes What You Need To Know

Understanding California S Property Taxes

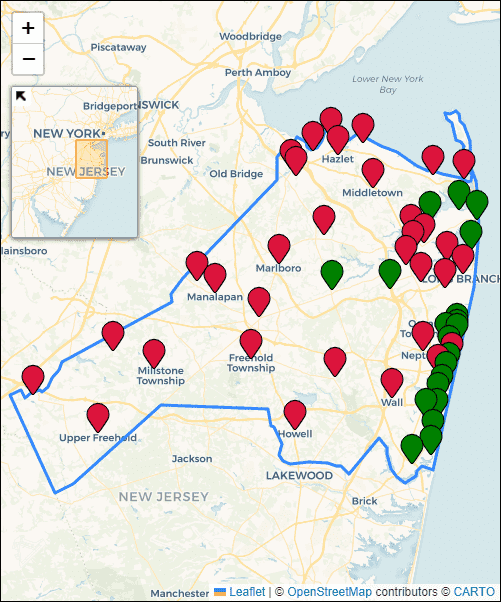

New Jersey 2021 Property Tax Rates And Average Tax Bills For All Counties And Towns

Property Tax Rates Average Tax Bills And Home Assessments For Monmouth County New Jersey

Which Cities And States Have The Highest Sales Tax Rates Taxjar

Understanding California S Property Taxes

Property Tax Rates Average Tax Bills And Home Assessments For Monmouth County New Jersey

Florida Sales Tax Rates By City County 2022

Florida State Taxes 2021 2022 Income And Sales Tax Rates Bankrate

County Surcharge On General Excise And Use Tax Department Of Taxation